Over the past 30 years, China has turned itself into the world’s largest factory region, concentrating no less than 28 percent of global industrial output. While other countries, namely the U.S., have criticized this concentration of production for some time, it took the Covid-19 pandemic to prove that having nearly all medical supplies produced in one place is not a good idea. That realization, coupled with a slowdown in the flow of people, should lead to a reorganization of global value chains with countries seeking to bring production closer to home.

Could that be an opportunity for Brazil to make a leap in development?

For people such as long time investor Mark Mobius, founder of Mobius Capital Partners, this is a real possibility. In an interview with CNBC, he said companies were keen on reorganizing their supply chains, and while Canada and Mexico would be more logical locations for U.S. companies, “there’s going to be diversification where these supply chains get moved into places like Vietnam, Bangladesh, Turkey, even Brazil.”

Changing a system that has been building up for so many years is no easy task, and will not happen overnight. But the first signs that the so-called “decoupling” of U.S. firms from China is here to stay are already popping up, with Apple moving part of its production to India and Vietnam. Also, as political tensions between the U.S. and China continue to boil over on issues such as trade and Beijing’s Hong Kong takeover, decentralization may be the new order of business.

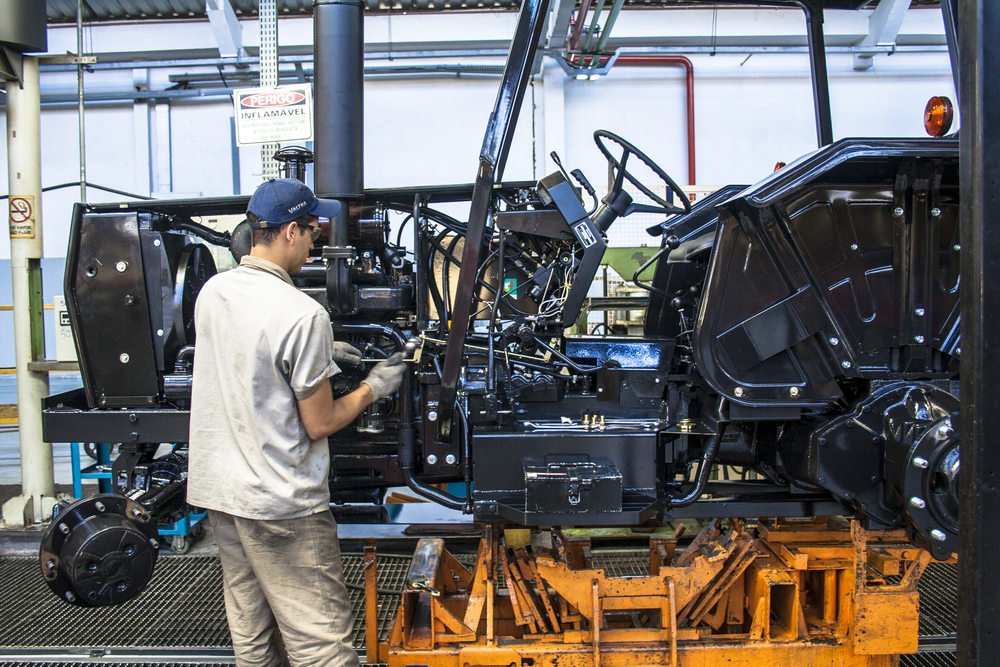

Meanwhile in Brazil, the economy is still feeling the impacts of Covid-19, with factories closing for good and industrial production falling 22 percent in May year-over-year. But industry experts believe that the country may be in a good position to become an attractive destination for investment — if it deals with its own internal challenges.

And that is a big if.

Brazil is better than it was, but not where it should be

In the past few years, Brazil has approved several reforms that aimed at reducing red tape and costs — such as the 2017 labor reform — or at balancing public...

Search

Search