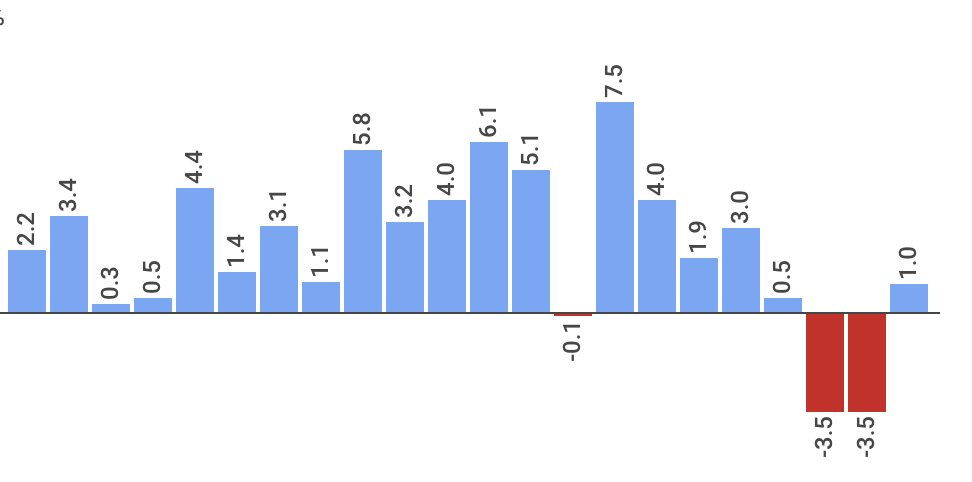

The Brazilian Institute of Geography and Statistics announced the official GDP growth rate for 2017: +1.0 percent. While it might not be much, it does signal the end of the longest recession in Brazilian history. Once again, the agribusiness sector was the motor of the economy, performing 13 percent better than it had in 2016.

GDP per capita was also up, growing by 0.2 percent to 31,587 BRL. Other positive numbers include growth in both exports and imports – by 5.2 and 5 percent, respectively. Most industrial sectors, except for construction, also performed better last year.

Search

Search