Nubank, the largest neobank in Latin America, has surpassed 90 million customers in the region. Nearly 85 million are in Brazil, and 5.2 million are in Mexico and Colombia.

The bank has achieved this by aggressively expanding its portfolio and seeking new licenses. The milestone was announced by David Vélez, Nubank’s founder and CEO, at an event for press and influencers in Mexico City this week.

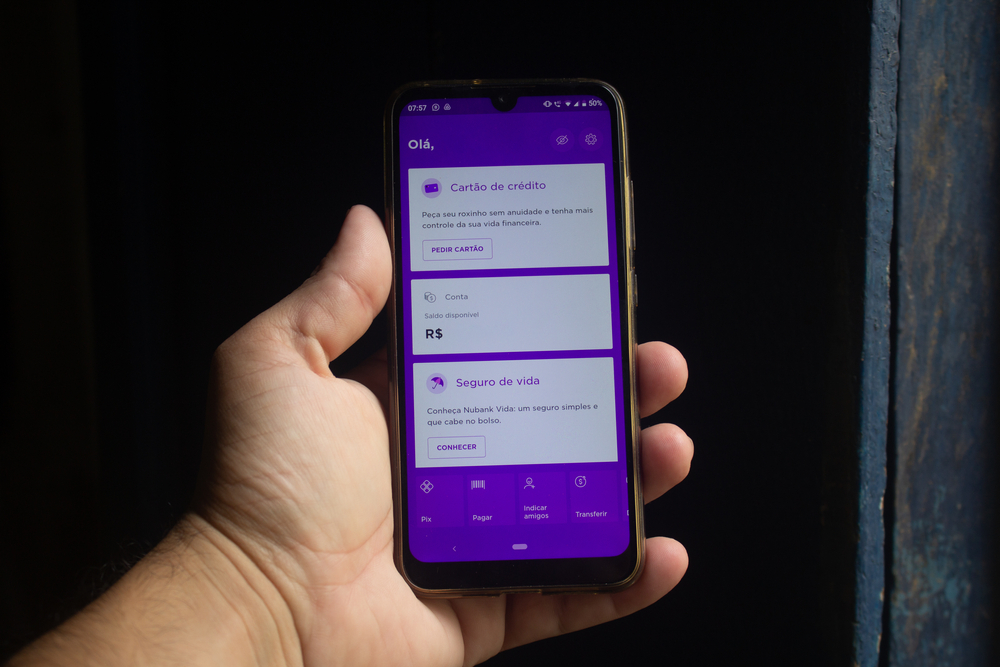

This year alone, Nubank has launched more than 40 new products and features in Brazil, including payroll loans for retirees and pensioners, new investment options, and special benefits for high-income customers who use its Ultravioleta credit card.

As a result, it was able to compete directly with the country’s largest banks. At the end of June, it was Brazil’s fourth-largest financial institution by number of customers and, more importantly, the primary banking relationship for nearly 60 percent of its base.

In Mexico, Nu is already the country’s largest Sofipo — a type of non-bank lender — and the fifth-biggest credit card issuer. Just months after launching its digital account in the country — its second product after the credit card — Nu México announced last week that it had applied for a banking license from the National Banking and Securities Commission (CNBV), the market regulator.

The neobank is growing faster in Mexico than it did in Brazil, but this growth is not without pain.

Nu Mexico had a delinquency rate of 9.95 percent in the 12 months ended August, according to CNBV data, above the Sofipo average of 9.74 percent. Nubank co-founder Cristina Junqueira told journalists that the company is not really aiming for low delinquency rates.

“We seek a profitable and sustainable operation,” she said, explaining that the main factor for the high delinquency rates is that 50 percent of Nu’s customers have never had a credit card before, and therefore, Nu’s risk assessment models in Mexico are not as mature as in Brazil, where the delinquency rate is 5.9 percent.

In addition, she said, Brazil’s profitable operations can support expansion in Mexico and Colombia.

Nu Holdings — the Nasdaq-listed company that combines Brazil’s Nubank, Nu Mexico, and Nu Colombia — ended the second quarter with a net income of USD 225 million, up from a loss of USD 30 million a year earlier.

A banking license will allow Nu Mexico to offer products such as investments, including shares on the Mexican stock exchange, corporate loans, and mortgages, among others.

In September, Nu Colombia reported a significant increase in the A/B loan provided by the International Finance Corporation (IFC) to support its operations. From the initial commitment of USD 150 million announced in January 2023, the amount raised from “commercial institutions” has now been increased to USD 265.1 million.

Nu Colombia has reached more than 700,000 customers, and nearly one in ten adults in the country uses its credit card. The company is awaiting a second license from the Superintendency of Finance of Colombia (SFC) to operate as a finance company. This will allow it to launch products for saving and managing money, i.e., digital accounts.

Search

Search