On April 14 of this year, the price of a single Bitcoin reached what was then an all-time high of around USD 64,870. Just over a month later, the price of the world’s most popular digital currency had tumbled to USD 34,259.

A significant driver behind this sudden drop was the news that China had begun a sweeping crackdown on the cryptocurrency industry, driven by concerns around financial risk and excessive energy consumption. Bitcoin “mining” — the process by which transactions are verified and new coins are created – is highly energy-intensive, leading to criticism over the currency’s oversized carbon footprint.

Before the clampdown, China accounted for two-thirds of Bitcoin mining worldwide. In the months since, mining companies have been quick to move their operations overseas. Recent data suggests that there have been increases in energy consumption attributable to Bitcoin in the U.S., Canada, and Kazakhstan. As a consequence, there is growing pressure to tackle the currency’s soaring electricity appetite.

Power-hungry Bitcoin mining

Bitcoin is a decentralized digital currency, meaning that each time money is sent or received, the transaction is kept on a public record, rather than with a bank. But in the absence of a trusted authority to verify each transaction, the responsibility falls to participants in the Bitcoin network known as “miners.”

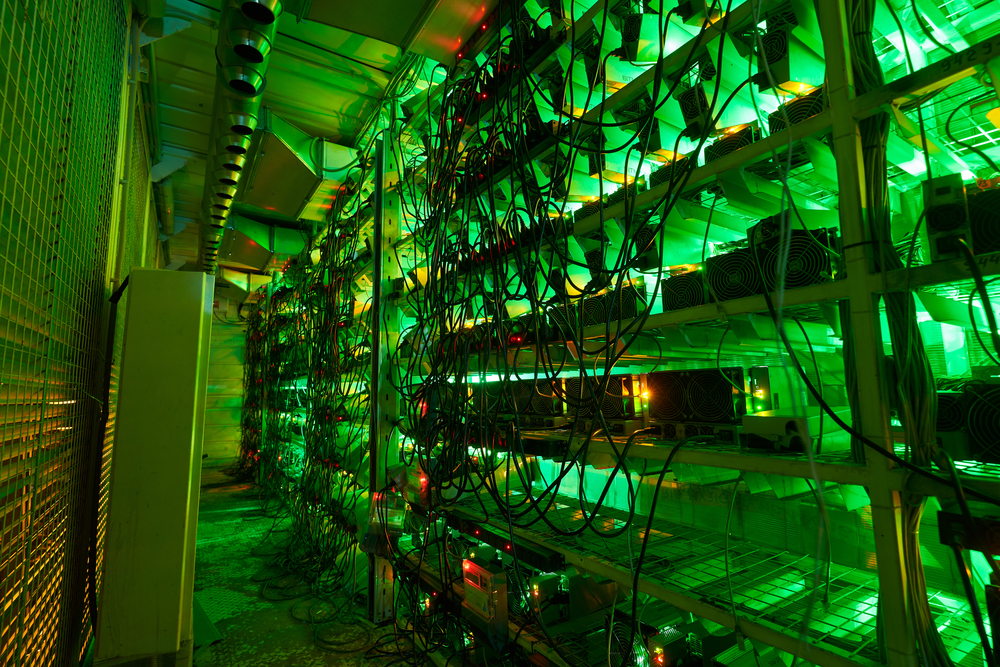

To verify transactions, miners connect computers to the cryptocurrency network and use them to solve incredibly complex, randomly generated mathematical puzzles. But not just any computer will do the job: Bitcoin mining requires the running of multiple specialized computers almost 24/7 in order to achieve the requisite computing power.

Whoever solves the puzzle first is allowed to add a “block” of transactions to the global ledger, and is rewarded with a small amount of newly minted Bitcoin.

Herein lies Bitcoin’s energy problem. The more computing power you can muster, the more often you will be the first to solve the puzzle and earn Bitcoin. So the machines used to mine Bitcoin – application-specific integrated units (ASICs) – consume a huge amount of energy.

In one year, the entire Bitcoin network consumes around 120 terawatt-hours (TWh) of energy, or more than the whole of the Netherlands, according to estimates by Cambridge University’s Bitcoin Electricity Consumption Index (CBECI). If Bitcoin were a country, it would rank 32nd in the world by annual electricity consumption.

“That’s the price we pay to secure transactions,” says Anton Dek, crypto asset and blockchain lead at the Cambridge Centre for Alternative Finance, and one of the creators of the index. Bitcoin’s energy usage isn’t an accidental by-product, he explains. Mining Bitcoin is purposefully designed to be costly – both in terms of electricity and money – to prevent would-be hackers from taking over the network.

So far, it seems to have worked. “We haven’t seen...

Search

Search