In 1984, Catholic seminarian Joaquim de Melo Neto decided to relocate to an open landfill in Conjunto Palmeiras, the largest favela in the north-eastern city of Fortaleza. Preparing himself for ordination, he wanted to experience extreme poverty first-hand and help the community thrive. Upon arrival, he saw over 25,000 people living without water, electricity, sewage, or fixed income, sharing the land with countless rats and vultures.

After helping the community to organize itself, Mr. Melo began using his knowledge of European cooperatives to instill a sense of belonging and solidarity among the residents of Conjunto Palmeiras. Under the slogan “No-one beats poverty alone,” the favela became an official neighborhood, with basic sanitation, running water, and electricity.

But, unable to pay for these utilities, the residents of Palmeiras began selling their houses and moving out of the neighborhood. A survey at the end of the 1990s showed that the community spent a total of BRL 1.2 million on monthly purchases, and 80 percent of what they consumed came from outside the neighborhood. The solution, then, became clear: if the money stayed in Palmeiras, people would be able to afford to live there.

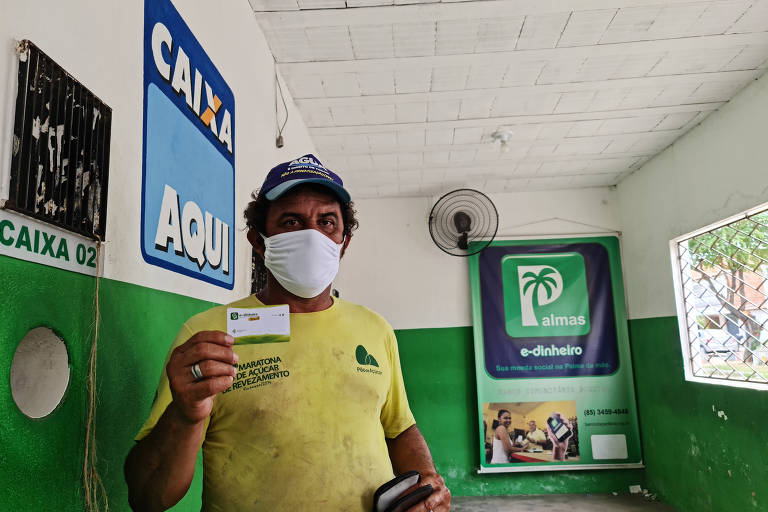

This idea led to the birth of Banco Palmas, Brazil’s first community bank. Though it was initially looked upon with suspicion — even being investigated by Brazil’s Central Bank — Palmas soon became a benchmark and inspiration for community banks all over the country. There are currently 103 such institutions, organized by the Brazilian Network of Community Banks, set up in 2006.

Local currency

Banco Palmas began with a loan of BRL 2,000 (USD 367). This credit was then made available to the local population by way of a new currency — the “palma” — which...

Search

Search