“The acquisition of local land by foreign government and foreign firms is a centuries-old process in much of the world. But we can detect specific phases in the diverse histories and geographies of such acquisitions. A major such shift began in 2006, marked by a rapid increase in the volume and geographical spread of foreign acquisitions.”

That’s how the Dutch-American sociologist Saskia Sassen, a professor at Columbia University and the London School of Economics, begins the second chapter of her 2015 book, Expulsions.

The process Sassen describes is based on different surveys, using multiple methodologies, that have detected a growing presence of foreign capital in land acquisition – Brazil included. Data from 2016 compiled by Land Matrix, a platform that monitors big land acquisitions, reveals that between 2000 and 2015, over 42 million hectares were purchased by foreign companies across the world – especially in the southern hemisphere. Out of this total, 26.7 million hectares were effectively bought, totaling 1,004 transactions over that 15-year span.

Brazil is among the top five countries in terms of surface involved in such transactions, alongside Russia, Indonesia, Ukraine, and Papua-New Guinea. Together, land dealt in those countries accounted for 46 percent of arable land purchases surveyed by Land Matrix.

Using another methodology, the NGO Grain has found that 28.9 hectares of land were dealt in 79 countries since 2008, in a process internationally known as “land grabbing.”

Grabbing Brazilian land

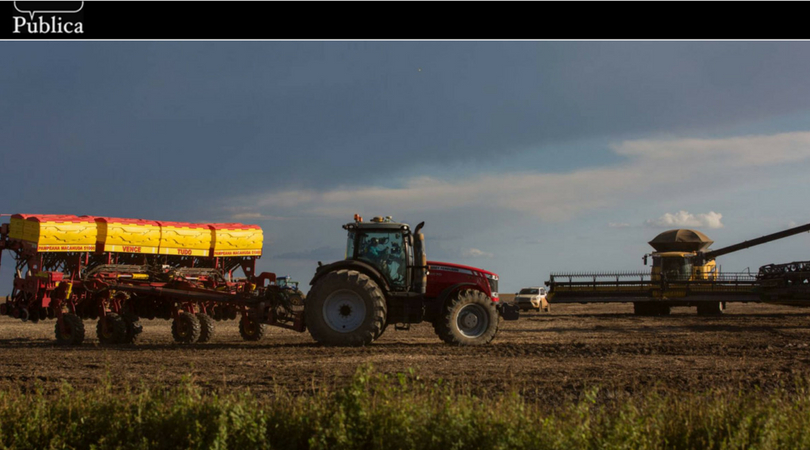

In Brazil, Mato Grosso and the Matopiba (an acronym to designate the states of Maranhão, Tocantins, Piauí, and Bahia) are the most sought-after regions for big acquisitions, according to Márcio Perin, from Informa Economics IEG/FNP, a consultancy firm.

The Matopiba is a region dominated by the ‘cerrado’, a savannah-like biome, and is considered to be Brazil’s last agricultural frontier. It was delimited by the Brazilian Agricultural Research Corporation (Embrapa) and the National Institute of Colonization and Agrarian Reform (INCRA) as the site for an agricultural development project sponsored by Senator Kátia Abreu (PSD-Tocantins). In May 2015, then-President Dilma Rousseff signed a decree creating the Matopiba project.

The region assembles conservation units, indigenous lands, and traditional ‘cerrado’ communities affected by the sudden valorization of the land and intensive crop farming. Land speculation and agribusiness expansion in the region, as well as human rights...

Search

Search