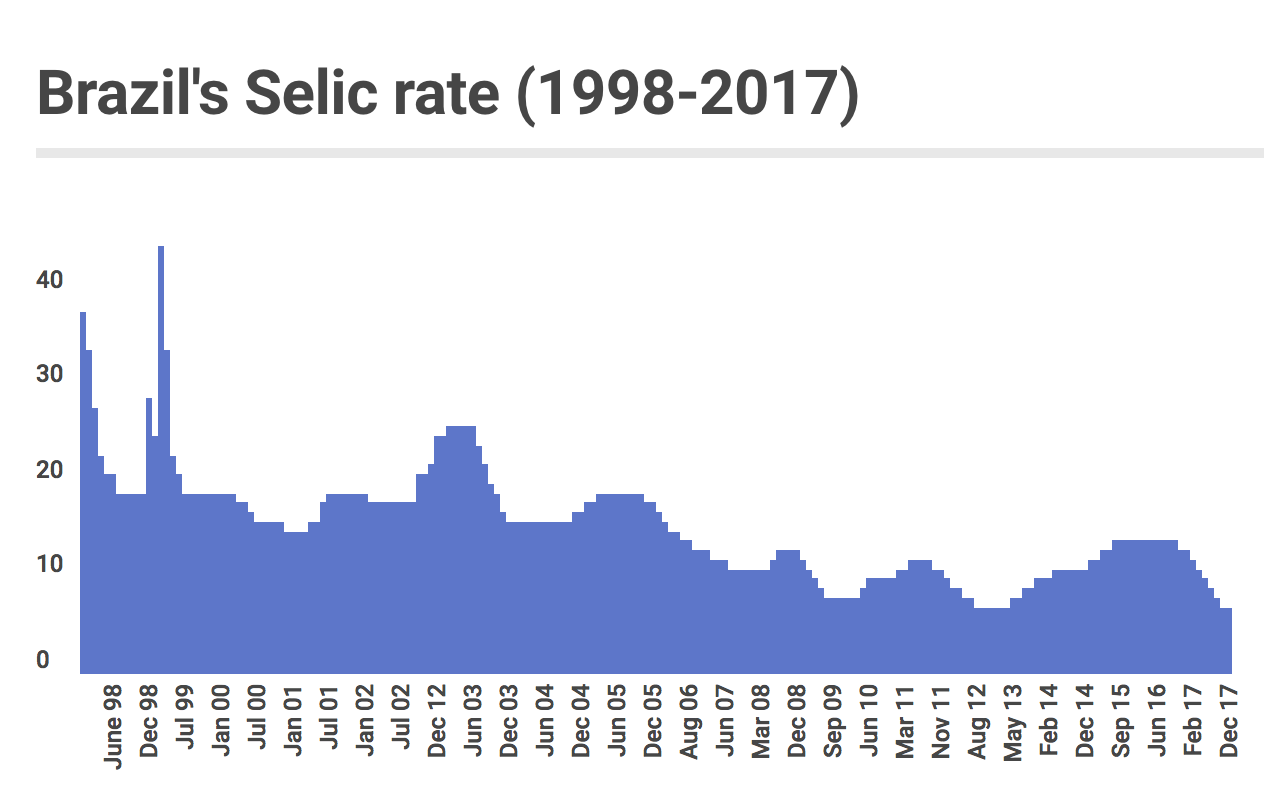

The Central Bank’s Monetary Policy Committee (Copom) decided on Wednesday to cut Brazil’s Selic benchmark interest rate by 0.50 to 7 percent per...

The Central Bank’s Monetary Policy Committee (Copom) decided on Wednesday to cut Brazil’s Selic benchmark interest rate by 0.50 to 7 percent per...

Search

Search