Join the community of diplomats, economists, and journalists who depend on The Brazilian Report for daily intelligence on Latin America’s largest democracy.

Join the community of diplomats, economists, and journalists who depend on The Brazilian Report for daily intelligence on Latin America’s largest democracy.

START YOUR 14-DAY FREE TRIAL

START YOUR 14-DAY FREE TRIAL

Read by professionals at

Read by

professionals at

Explore our

NEWSLETTERS

Explore our

NEWSLETTERS

Explore our

NEWSLETTERS

Don't miss a beat. Our newsletter gives you clear, trusted insights into Brazil and Latin America’s latest developments — keeping you informed, engaged, and ready for what’s next.

Don't miss a beat. Our newsletter gives you clear, trusted insights into Brazil and Latin America’s latest developments — keeping you informed, engaged, and ready for what’s next.

Don't miss a beat. Our newsletter gives you clear, trusted insights into Brazil and Latin America’s latest developments — keeping you informed, engaged, and ready for what’s next.

Guide to

BRAZIL

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

SPORTS

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

CLIMATE

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

BUSINESS

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

AGRO

Essential for anyone following global food markets — with updates on Brazil’s pivotal role in food security.

Guide to

BRAZIL

Go beyond the surface and dive into Brazilian culture, news, and societal trends.

Brazil

BUSINESS

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

CLIMATE

Updates on Brazil's environmental impact — because what happens here affects the planet.

Brazil

AGRO

Essential for anyone following global food markets — with updates on Brazil’s pivotal role in food security.

Brazil

SPORTS

More than scores, we explore Brazilian sports' powerful stories and business side.

Guide to

BRAZIL

Go beyond the surface and dive into Brazilian culture, news, and societal trends.

Brazil

BUSINESS

Your guide to the largest economy in Latin America, from finance to infrastructure and innovation.

Brazil

CLIMATE

Updates on Brazil's environmental impact — because what happens here affects the planet.

Brazil

AGRO

Essential for anyone following global food markets — with updates on Brazil’s pivotal role in food security.

Brazil

SPORTS

More than scores, we explore Brazilian sports' powerful stories and business side.

7 newsletters, AM and PM, straight to your inbox.

You choose what you want to receive.

7 newsletters, AM and PM, straight to your inbox.

You choose what you want to receive.

AWARD-WINNING NEWSROOM

AWARD

WINNING NEWSROOM

best newsletter

best newsletter

WAN-IFRA 2023 · 2025

WAN-IFRA 2023 · 2025

best

story

best

story

2024 Digiday Media Awards

2024 Digiday Media Awards

Join our

debates

Join our

DEBATES

Join our

debates

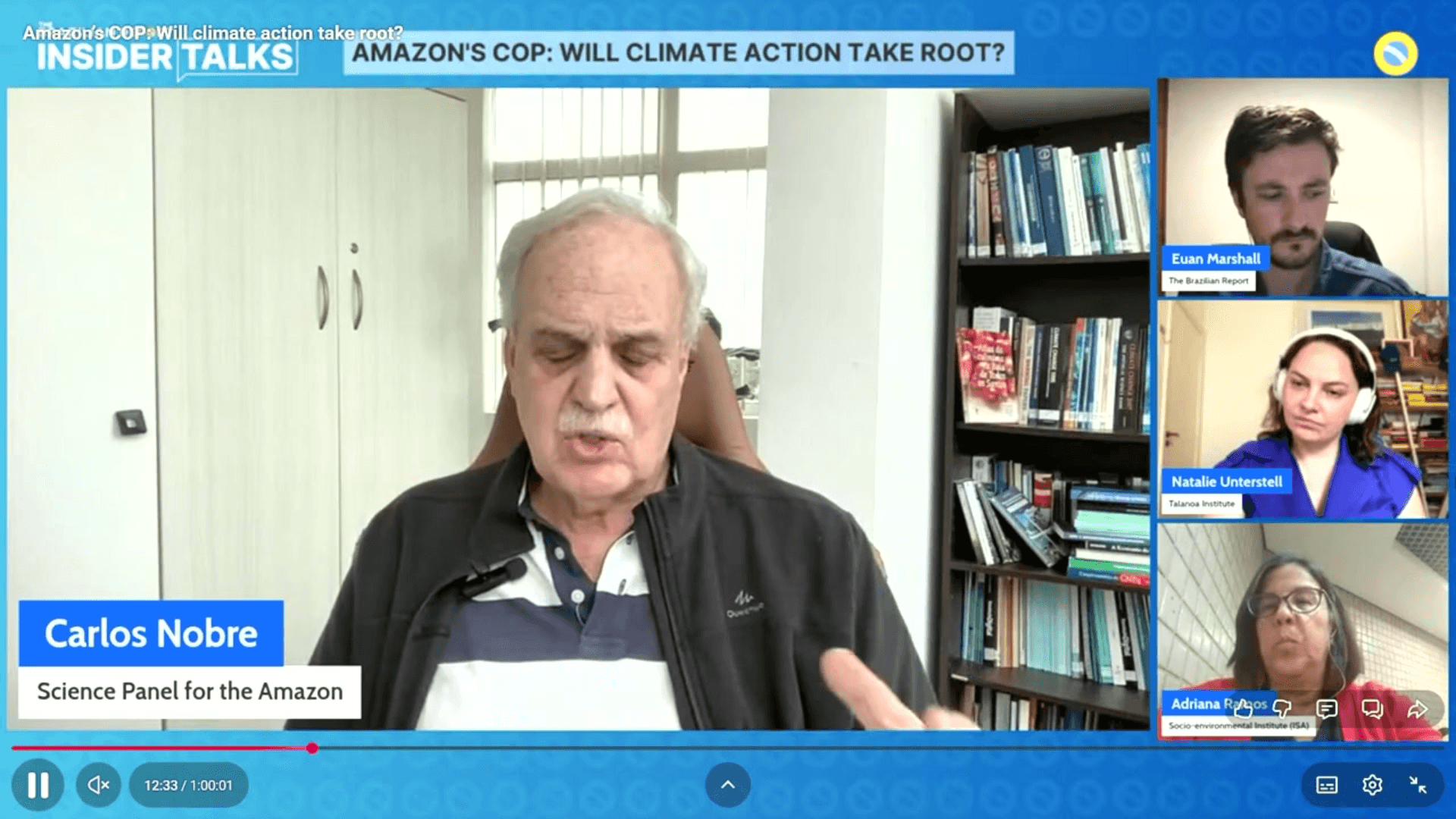

Every two months, we invite top-tier experts to discuss pressing issues related to Brazil, and share exclusive insights that decision-makers recognize as invaluable

Every two months, we invite top-tier experts to discuss pressing issues related to Brazil, and share exclusive insights that decision-makers recognize as invaluable

Every two months, we invite top-tier experts to discuss pressing issues related to Brazil, and share exclusive insights that decision-makers recognize as invaluable

Reasons to

subscribe

Reasons to

SUBSCRIBE

Reasons to

subscribe

Reasons to

subscribe

Your time is valuable, and so is staying informed. Subscribing gives you direct access to curated stories, expert opinions, and all the tools you need to stay ahead.

Your time is valuable, and so is staying informed. Subscribing gives you direct access to curated stories, expert opinions, and all the tools you need to stay ahead.

Your time is valuable, and so is staying informed. Subscribing gives you direct access to curated stories, expert opinions, and all the tools you need to stay ahead.

Voices that cut

through the noise

Voices that cut

through the noise

Voices that cut

through the noise

Hear directly from the people who know the stories best. Our writers are industry experts who break down complex topics with a unique perspective and a clear voice.

Hear directly from the people who know the stories best. Our writers are industry experts who break down complex topics with a unique perspective and a clear voice.

Hear directly from the people who know the stories best. Our writers are industry experts who break down complex topics with a unique perspective and a clear voice.

Comprehensive

COVERAGE

IN ONE PLACE

Comprehensive

COVERAGE

IN ONE PLACE

Comprehensive

COVERAGE

IN ONE PLACE

Why subscribe to dozens of newsletters when you can get everything in one?

Business, climate, society, and beyond—we’ve got it covered.

Why subscribe to dozens of newsletters when you can get everything in one?

Business, climate, society, and beyond—we’ve got it covered.

Why subscribe to dozens of newsletters when you can get everything in one?

Business, climate, society, and beyond—we’ve got it covered.

Tailored content

DIRECT TO YOUR INBOX

Tailored content

DIRECT TO YOUR INBOX

Tailored content

DIRECT TO YOUR INBOX

Handpicked stories that make a difference, delivering only what matters, straight to your inbox. Ensuring you receive high-quality content that’s relevant, timely, and valuable.

Handpicked stories that make a difference, delivering only what matters, straight to your inbox. Ensuring you receive high-quality content that’s relevant, timely, and valuable.

Handpicked stories that make a difference, delivering only what matters, straight to your inbox. Ensuring you receive high-quality content that’s relevant, timely, and valuable.

Get smarter about Brazil

Get smarter about Brazil

Get smarter about Brazil

START YOUR 14-DAY FREE TRIAL

START YOUR 14-DAY FREE TRIAL

Join the

CONVERSATION

Join the

CONVERSATION

HEAR FROM OUR READERS

HEAR FROM OUR READERS

HEAR FROM OUR READERS

"I discovered your service as I begin my Portuguese language learning journey. I have a background in International Trade Compliance and am finding your service delightfully informative and greatly appreciate the depth of your analysis - Love your work!"

"I discovered your service as I begin my Portuguese language learning journey. I have a background in International Trade Compliance and am finding your service delightfully informative and greatly appreciate the depth of your analysis - Love your work!"

James Z.

James Z.

TBR Subscriber

TBR Subscriber

"The Brazilian Report is a great source for English speakers interested in understanding current events in Brazil. Thanks for the work you do."

"The Brazilian Report is a great source for English speakers interested in understanding current events in Brazil. Thanks for the work you do."

Steve K.

Steve K.

TBR Subscriber

TBR Subscriber

Fantastic coverage, focused on Brazil yet relevant globally!

Fantastic coverage, focused on Brazil yet relevant globally!

Andrey N.

Andrey N.

TBR Subscriber

TBR Subscriber

© 2024 - The Brazilian Report -

News from Brazil in English | Politics, Economics

© 2024 - The Brazilian Report -

News from Brazil in English | Politics, Economics

© 2024 - The Brazilian Report -

News from Brazil in English | Politics, Economics

© 2024 - The Brazilian Report -

News from Brazil in English | Politics, Economics